Depreciation Journal Entry Step by Step Examples

Content

However, there are no specific journal books for recording the machinery transactions. Machinery Account is recorded as asset or inventory per the business’s nature. Understanding the nature of the transaction is a prerequisite for recording the journal entry. We need to replace the machinery account with the furniture account; refer to the above journal entry. As you have seen, when assets are acquired during an accounting period, the first recording of depreciation is for a partial year.

The loss or gain on sale is therefore calculated as the net disposal proceeds, minus the carrying value of the asset. When all accumulated depreciation and any accumulated impairment charges are subtracted from the original purchase price of the asset, the result is the carrying value of the asset. Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2014.

The Accounting University with 3400+ Accounting contents as study material which can watch, read and learn anyone, anywhere.

Long-term assets are used over several years, so the cost is spread out over those years. Short-term assets are put on your business balance sheet, but they aren’t depreciated. Long-term assets that can be depreciated include buildings, machinery, equipment, furniture, and vehicles. Written Down Value Method The written down value method is a tool to evaluate the depreciation in a company’s fixed asset to determine the correct valuation of the asset’s value.

Is machinery depreciation a debit or credit?

In accounting, a depreciation account is a debit balance since it is an expense.

Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance in accumulated depreciation of $8,400 at December 31, 2017. Prepare journal entries to update depreciation for 2018 and record the sale. When you first buy new, long-term equipment (i.e., fixed assets), it doesn’t go on your income statement right away. Instead, record an asset purchase entry on your business balance sheet and cash flow statement. At the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries.

What’s the Difference Between Total Assets and Net Assets?

If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account. In accounting, software for internal use is treated differently from software purchased or developed to sell to others. Depreciate a leased asset over its service life without considering the asset’s proper life. If you can’t measure the value of an exchanged asset, carry over the value of the original asset. Operating assets allow an organization to function daily and thereby make money or create other outputs. These assets can include buildings, cash, copyrights, equipment, goodwill and more.

- These entries are designed to reflect the ongoing usage of fixed assets over time.

- Prepare journal entries on the books of Duffner Company to record these transactions.

- Depreciation reflects the loss in value of the equipment as you use it.

- Assets that don’t have a significant market worth generally have depreciation accounted for entirely during their acquisition period.

Streamline and automate detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching all in one centralized workspace. Drive visibility, accountability, and control across every accounting checklist. For Instance, consider ABC Company with the following GL accounts. Learn the difference between daily summary and per transaction recording in our blog. Synder provides a comprehensive solution for recording the transactions in bulk – daily summaries. Price of new, $215,000; trade-in allowance on old, $44,000; balance paid in cash.

What Is Fixed-Asset Accounting?

Let’s say you have a car used in your business that has a value of $25,000. It depreciates over 10 years, so you can take $2,500 in depreciation expense each year. Land and Buildings are listed first, but land is never depreciated.

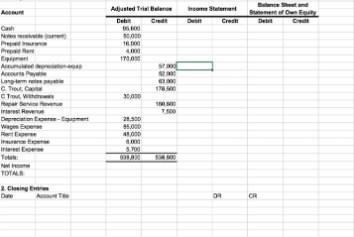

Once depreciation has been calculated, you’ll need to record the expense as a journal entry. The journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. Because the original fixed asset was recorded as a debit in the asset account, the accumulated depreciation will be recorded as a credit.

Accumulated Depreciation on Balance Sheet

Please do not create doubt about showing depreciation loss in credit side. This entry is the part of closing of accounts at the end of year. There is one disadvantage of this method, which is that it is not possible to find out the original cost of an asset and what is the journal entry for depreciation on machinery the total amount of depreciation. The total value of all the assets of a company is listed on the balance sheet rather than showing the value of each individual asset. Most capital assets have a residual value, sometimes called “scrap value” or salvage value.

- These assets can include buildings, cash, copyrights, equipment, goodwill and more.

- An asset’s estimated salvage value is an important component in the calculation of depreciation.

- Accumulated depreciation refers to the sum of all depreciation recorded on an asset to a specific date.

- By monitoring cash flow on a daily basis, businesses can make informed decisions about their operations and financial strategies and ensure their long-term financial stability and planning.

Management at a company makes this decision based on numerous critical factors, such as the asset’s type, the nature of its use, and the current business conditions. There are instances when it’s necessary to employ a mix of methods. Assets that don’t have a significant market worth generally have depreciation accounted for entirely during their acquisition period. Using the preceding examples, we will subtract the accumulated depreciation of $15,000 from the machinery’s original cost of $50,000.

Impairment Loss Journal Entry

Debit the Accumulated Depreciation Account by the amount of depreciation claimed over the life of the asset. A fully depreciated asset has already expended its full depreciation allowance where only its salvage value remains. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

Learn how NetSuite enables you to streamline revenue accounting function to ensure compliance with current and future guidelines. An estimated value of the costs of dismantling and removing the asset and restoring the site on which it is located. This is commonly referred to as an asset retirement obligation . Finally, accountants will determine the residual value or salvage value of the asset, which is what the asset will likely sell for at the end of its useful life.

Can you record depreciation in a journal entry?

Once depreciation has been calculated, you'll need to record the expense as a journal entry. The journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application.