Microsoft Net Income 2010-2023 MSFT

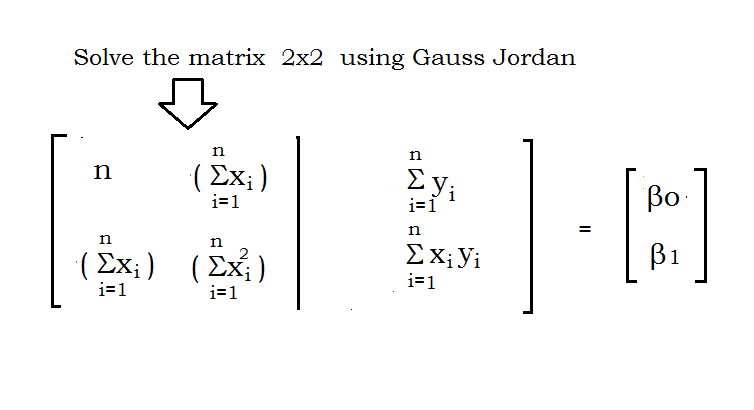

Understanding and calculating your net income is thus essential to get insights into the additional expenses that you can pay. Annual net income is the total money earned in a span of 12 months after specific subtractions are done from your gross income. To analyze your annual net income, you must ensure deducting specific costs from your overall gross income. Your paycheck will also consist of your annual net income listed below.

Lovesac to restate yearly, quarterly income figures following internal … – Furniture Today

Lovesac to restate yearly, quarterly income figures following internal ….

Posted: Fri, 18 Aug 2023 13:28:48 GMT [source]

Pretax is more advantageous to employees because it lowers the individual’s taxable income. As seen before with Best Buy, Macy’s gross profit of over $2.2 billion dramatically differs from its net income. Due to SG&A costs, settlement charges, interest expenses, impairment and restructuring costs, and income taxes, Macy’s net income for the period was just $108 million. For example, if a company didn’t hire enough production workers for its busy season, it would lead to more overtime pay for its existing workers.

How to calculate net income for business

Think of it as the profit you’ve made from the services you provide—the sum of all your client billings before any deductions, taxes, or withholding. Understand how gross income and net income are defined in order to understand their key differences. Because net income subtracts your expenses, taxes and interest on debt, it will typically be a lower number than gross profits. With an understanding of gross vs. net income, you can calculate your net income by taking your gross income and subtracting your expenses, taxes and interest on debt. Although net income is considered the gold standard for profitability, some investors use other measures, such as earnings before interest and taxes (EBIT).

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Unlike withholding certificates and other employment documents, paychecks are pretty easy to decipher. Reading them is simply a matter of making sure the payment information is correct. Calculations, however, are just one piece of the larger paycheck picture.

Annual Net Income % Change figures give a more long-term perspective than quarterly figures. And net income is important because it allows the store’s owners and managers to calculate their net profit margin. In this case, the store’s profit margin would equal $90,000 divided by $250,000, or 36%. This means that for every dollar of sales the store achieved, it netted 36 cents in profit for the period. When business owners review their revenue over various periods, they need to do so before deducting any expenses. That’s the only way they can track their sales over time, the average size of sales and seasonality.

When looking to invest, review the company’s net annual income — often found on the company’s corporate documents or a financial website. Compare the annual net incomes of similar companies to determine if you should invest. Remember that net income is just one of many factors to consider in an investment decision. For individuals, gross income is the total pay you earn from employers or clients before taxes and other deductions. This is not limited to income received as cash, as it can also include property or services received. On the other hand, net income refers to your income after taxes and deductions are taken into account.

What is the difference between gross income and annual net income?

More detailed definitions can be found in accounting textbooks or from an accounting professional. Net income can give you an overall idea of the health of a business, because it shows profits after all deductions are taken out. If there are major differences between gross and net income, it can be a warning sign. It could mean that expenses are too high, income is too low, or both. This number is important on its face because it tells the store’s owners and managers how much money they made over the quarter, after expenses.

- For this reason, employees may want to save their pay stubs, but aren’t required to do so.

- For individuals, net income matters because it shows you how much money you may be able to spend.

- To calculate your personal annual net income, begin with your total revenue for the year and subtract your expenses.

- To know more about calculating net income, check out our gross to net calculator.

Sometimes referred to as net sales, revenue is the total amount of money your company earns from selling goods and services in a given time. In addition to revenue generated from your business’s core activities, you may also have non-operating revenue. Net income, on the other hand, represents the income or profit remaining after all expenses have been subtracted from revenue. It also includes other income sources, such as income from the sale of an asset.

Importance of gross income in business

Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments. Net income can be misleading—non-cash expenses are not included in its calculation. Here are examples of net income for both a business and an individual.

Annual net income usually is reported in dollar figures or expressed in percentage terms, called the profit margin, which is net income divided by revenue. That number might shift over time, but it’s important to be aware of what a company is bringing in after expenses. Investors looking to evaluate a company’s performance can look at net income to determine how well they’re doing. The calculation is a given year’s net income minus the prior year’s net income, divided by the prior year’s net income.

Why is gross income important in business?

Also referred to as the “bottom line,” net annual income is usually listed at the bottom of an income statement for a company or individual. The terms “annual net income” and “net income” are often used interchangeably, but when it comes to net annual income, we’re looking at a complete year of finances. Our guide will show you how to calculate Annual Net Income, what it means, and when to use it.

Though certain tax credits or deductions may closely relate to gross profit, government entities are more interested in a company’s net income when assessing tax. If gross profit is positive for the quarter, it doesn’t necessarily mean a company is profitable. For example, a company could be saddled with too much debt, resulting in high interest expenses. These can wipe out gross profit and lead to a net loss (or negative net income). For example, a company might increase its gross profit while borrowing too much.

Many small businesses with simple operations calculate net income using a single-step income statement, starting with revenue and then subtracting expenses and taxes. Typical expenses for a small business include rent or mortgage payments for office or production space, utilities, employee pay, and insurance and taxes. For businesses, net income is the number you get when you subtract business expenses, operating costs and taxes from total revenue.

One other thing to know when figuring out net income for a business is the cost of goods sold (COGS). According to Bankrate, COGS includes the amount of money a company spends on making or acquiring goods for resale. Companies often use an income statement, which typically shows all income and expenses. The net income is usually found at the bottom of the income statement. Whether you want to pay off debt, create a manageable budget or save for a home, understanding net income could be the first step in managing your money. For individuals, net income matters because it shows you how much money you may be able to spend.

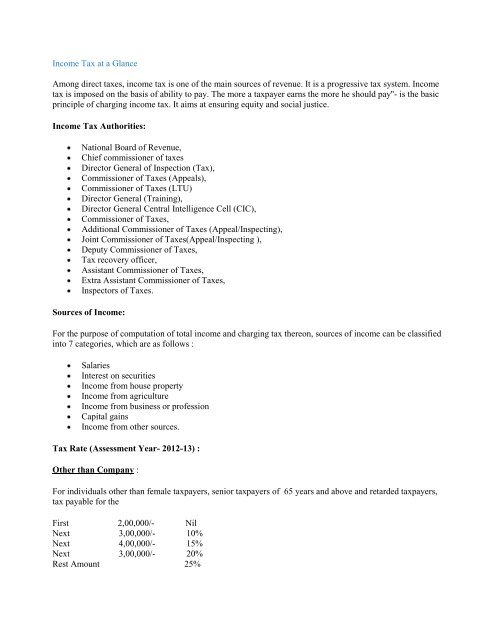

This tax expense should thus be subtracted from your gross income to evaluate your overall annual net income. Outside investors also examine annual net income, especially growth trends, before they offer to buy a stake in a small business. Your taxable income is what’s left after subtracting standard deductions, and it can be significantly less than your gross income. Your gross income is more than just a starting point on your tax forms, though.

Gross Profit

Most often, individuals also receive royalties from certain publishings. The publishing contract often dictates the respective terms of royalty accounting. Thus, for instance, openers receive royalties about twice every year on income that they received about nine months ago.

- Net income is the total amount of money your business earned in a period of time, minus all of its business expenses, taxes, and interest.

- It can also figure out an hourly rate, which may be useful when looking through job offers.

- On the other hand, net income is a specific number you can find on the bottom line of an income statement or by using the net income equation.

- Investors and lenders sometimes prefer to look at operating net income rather than net income.

Lenders and financial institutions use net income information to assess a company’s creditworthiness and to make lending decisions. As a result, banks often require a company to provide an income statement (and often a multi-year income statement) before issuing credit. Though the bank may underwrite based on the gross profit of primary product lines, banks are most interested in seeing net cash flow after all expenses (especially interest). Annual net income is the remaining amount after expenses are deducted from total revenue.

When trying to figure out business net income, start with the total revenue and then subtract business expenses, operating costs and taxes. The number you get after doing that represents the company’s net income. Net income represents a company’s overall profitability after all expenses and costs have been deducted from total revenue. Net income also includes any other types of income that a company earns, such as interest income from investments or income received from the sale of an asset.