At the Money ATM: Definition & How It Works in Options Trading

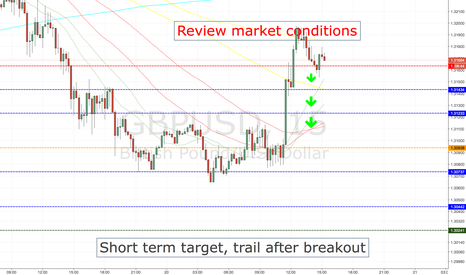

The stability of the demand for money prior to the 1980s was a key finding of Milton Friedman and Anna Schwartz[48] supported by the work of David Laidler,[49] and many others. The nature of the demand for money changed during the 1980s owing to technical, institutional, and legal factors[clarification needed] and the influence of monetarism has since decreased. ATM options typically hold the highest time value, while also exhibiting a high rate of time decay.

- Think about the whole life costs of a product or service, not just the initial purchase price.

- M0 is also the only money that can satisfy the reserve requirements of commercial banks.

- That value is affected by the volatility of the market in each period and the passage of time.

- This is because the savings from choosing the most cost-effective option can be significant.

- In-the-money options are often automatically exercised if they are far enough in-the-money, but at-the-money options are not.

We want to clarify that IG International does not have an official Line account at this time. We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. 72% of retail client accounts lose money when trading CFDs, with this investment provider. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Creation of money

In the 10th century, the Song dynasty government began circulating these notes amongst the traders in their monopolized salt industry. The Song government granted several shops the sole right to issue banknotes, and in the early 12th century the government finally took over these shops to produce state-issued currency. The already widespread methods of woodblock printing and then Pi Sheng’s movable type printing by the 11th century was the impetus for the massive production of paper money in premodern China. Bank money, whose value exists on the books of financial institutions and can be converted into physical notes or used for cashless payment, forms by far the largest part of broad money in developed countries. At the money refers to the situation where the strike price of an option is the same as or very similar to the current market price of the security. Both the call and put options can be at the money at the same time.

For calls, intrinsic value is equal to the stock price minus the strike price. This sensitivity of delta to price changes is measured by gamma, which is a very important risk measurement for options. Mathematically gamma is second to option premium with respect to the underlying price. In other words, it measures how rapidly losses can accelerate when the market moves against the option. Potential to earn big – If you study the market changes diligently, you have the potential to earn big with the money options. They are also cheaper than in the money options while both capitalize on small price changes of the market.

Technically the $50 call meets the definition of in the money, and the $50 put meets the definition of out of the money. However, in practice the market price and strike prices are so close that they are considered to be at the money. Note that options can be considered at the money when the market price and strike price aren’t exactly the same.

Account Money definition

So, you also get a chance to earn big margins with at the money options. Similarly, put options give the seller the right to sell a security at a price. It should be noted that it only gives them the right, not the obligation to sell. The at the money put option is the same as the market price of the security. Once again, the put price of the security from the example above will be $100 — the same as the market price.

In other words, the money supply is the number of financial instruments within a specific economy available for purchasing goods or services. Consider options with a strike price of $50 with the underlying asset trading at $50.98. In this situation both the $50 call and the $50 put would be considered at the money, even though the strike price is slightly lower than the market price of the underlying.

What is ATM?

However, they did not displace commodity money and were used alongside coins. These gold standard notes were made legal tender, and redemption into gold coins was discouraged. By the beginning of the 20th century, almost all countries had adopted the gold standard, backing their legal tender notes with fixed amounts of gold. At this time both silver and gold were considered legal tender, and accepted by governments for taxes. However, the instability in the ratio between the two grew over the 19th century, with the increase both in the supply of these metals, particularly silver, and of trade. This is called bimetallism and the attempt to create a bimetallic standard where both gold and silver backed currency remained in circulation occupied the efforts of inflationists.

For example, if XYZ stock is trading at $75, then the XYZ 75 call option is ATM and so is the XYZ 75 put option. ATM options have no intrinsic value, but will still have extrinsic or time value prior to expiration, and may be contrasted with either in the money (ITM) or out of the money (OTM) options. In the U.S., the Federal Reserve is responsible for controlling the money supply, while in the Euro area the respective institution is the European Central Bank. Other central banks with a significant impact on global finances are the Bank of Japan, People’s Bank of China and the Bank of England.

At the money put

Once the current market price is also $12, then the option is at the money. If it rises beyond this point the option will be in the money, as it now has a value, but if it falls it will be out of the money and cannot be exercised. In most major economies using coinage, copper, silver, and gold formed three tiers of coins. Gold coins were used for large purchases, payment of the military, and backing of state activities.

With European options the time value is negative whenever the intrinsic value is higher than the total value. For American options the trader can exercise the option profitably whenever the time value turns negative. The term “near the money” is sometimes used to describe an option that is within 50 cents of being ATM. For example, assume an investor purchases a call option with a strike price of $50.50 and the underlying stock price is trading at $50.

When gold and silver are used as money, the money supply can grow only if the supply of these metals is increased by mining. However, if the rate of gold mining cannot keep up with the growth of the economy, gold becomes relatively more valuable, and prices (denominated in gold) will drop, causing deflation. Deflation was the more typical situation for over a century at the money meaning when gold and paper money backed by gold were used as money in the 18th and 19th centuries. M0 is base money, or the amount of money actually issued by the central bank of a country. It is measured as currency plus deposits of banks and other institutions at the central bank. M0 is also the only money that can satisfy the reserve requirements of commercial banks.

What Is an At-the-Money Option?

Eventually, these receipts became generally accepted as a means of payment and were used as money. Paper money or banknotes were first used in China during the Song dynasty. These banknotes, known as “jiaozi”, evolved from promissory notes that had been used since the 7th century.

In the case of ITM and OTM options most of the time value of the option is lost long before the expiration of the option. But ATM options keep a good deal of time value until very close to their expiration. This is because it requires just a small move in the price of the underlying for the option to move into the money, thus gaining a substantial amount of intrinsic value. It is common for the time decay of an ATM option to accelerate dramatically near expiration. If you sell the call at an out-of-the-money price, it’s less likely to be exercised, but the premium won’t be as high.

The trader is betting that there will be a significant move either up or down. At-the-money (ATM) options have a strike price that is equal to its underlying stock’s market price. At-the-money options have no intrinsic value, but because they have time value, they could potentially earn profits before they expire.

Going by the above example, the at the money call option for a security market priced at $100 would be $100. Moneyness describes the relationship between the strike price and the market price of an underlying asset. At the money is the point where the strike price and the market price are the same. The strike price and the market price can be identical, similar, and slightly off by a small margin. Intrinsic value is the profit you would realize by exercising the option immediately.

Two other concepts of moneyness are “In the Money” (ITM) and “Out of the Money” (OTM). In the money options have a positive intrinsic and time value, while out of the money options have no intrinsic value. ITM options are profitable if exercised, while OTM options have no value when exercised. It is possible for both call options and put options of the same underlying assets to be at the money at the same time. For example, a $50 call and a $50 put will both be at the money if the underlying asset has a market value of $50. A straddle is a strategy of buying both call and put options for the same strike price and same expiration date for a security.

Governments at this point could use currency as an instrument of policy, printing paper currency such as the United States greenback, to pay for military expenditures. They could also set the terms at which they would redeem notes for specie, by limiting the amount of purchase, or the minimum amount that could be redeemed. In premodern China, the need for credit and for circulating a medium that was less of a burden than exchanging thousands of copper coins led to the introduction of paper money. This economic phenomenon was a slow and gradual process that took place from the late Tang dynasty (618–907) into the Song dynasty (960–1279). It began as a means for merchants to exchange heavy coinage for receipts of deposit issued as promissory notes from shops of wholesalers, notes that were valid for temporary use in a small regional territory.