RIGL Rigel Pharmaceuticals Inc Stock Price Quote NASDAQ

Contents:

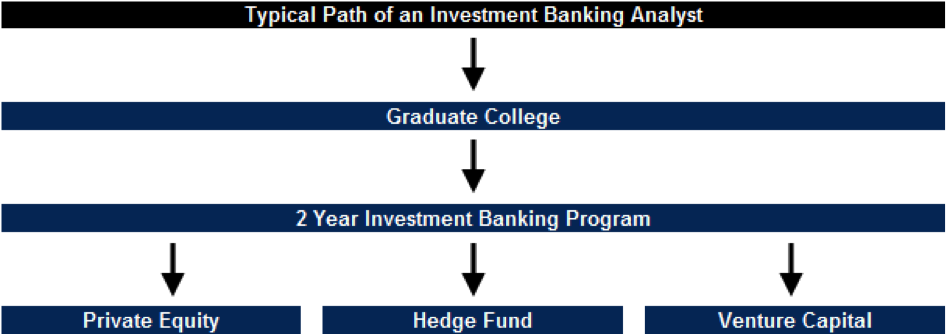

Putting these things together, it wouldn’t be hard for RIGL to come up with something positive regarding Rezlidhia with Q1’23 earnings. RIGL has announced that it will report Q1’23 earnings on Tuesday, May 2, 2023, and so confirmation of the CEO’s statements regarding Tavalisse might aid a reversal in the stock, which is trading around year-to-date lows. RIGL is a two drug company nowadays, with the recent approval and launch of Rezlidhia, but Tavalisse is still a major story and Q1’23 earnings could see record sales.

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Style is an investment factor that has a meaningful impact on investment risk and returns.

Bloomberg Markets European Close

use your telephone as an alternative of a card at was approved on December 1, 2022, in certain relapsed/refractory acute myeloid leukemia patients (r/r AML) with an IDH1 mutation, and only became commercially available on December 22, 2022. As such, Rezlidhia’s net product sales of $0.9M in Q4’22 were never going to be huge. A total of 64 bottles were shipped to distributors, with two shipped on to patients and clinics in Q4’22. FDA review ongoing for olutasidenib NDA; preparations underway for potential launch Third quarter TAVALISSE® net product sales of $19.2 million and total revenues of $22.4 million Conference call and … We sell different types of products and services to both investment professionals and individual investors.

The P/E ratio of Rigel Pharmaceuticals is -3.29, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. A $90M net sales run rate based on Q4 sales was mentioned by the CFO, which might be conservative given that Q1’23 is tracking better than expected. Secondly, with net revenues for Rezlidhia expected in 2023, that drug can make a contribution as well.

Premarket Mover: Rigel Pharmaceuticals Inc (RIGL) Up 1.90% – InvestorsObserver

Premarket Mover: Rigel Pharmaceuticals Inc (RIGL) Up 1.90%.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

Verify your identity, personalize the content you receive, or create and administer your account. We’d like to share more about how we work and what drives our day-to-day business. ST. LOUIS, Mo.—-Optime Care, a member of the AscellaHealth Family of Companies , today announced a contractual partnership with Rigel Pharmaceuticals, Inc., bringing its full suite … Rigel doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

FAQs for Rigel Pharmaceuticals Inc Stock

Rigel Pharmaceuticals has received a consensus rating of Hold. The company’s average rating score is 2.43, and is based on 3 buy ratings, 4 hold ratings, and no sell ratings. A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Results from the COVID-19 trial of fostamatinib are still possible in 2023, with the clinicaltrials.gov entry for the ACTIV-4 study being updated on February 23 with an estimated primary completion date of August 29, 2023. I think investors can hope for some more details on RIGL’s expected expenses and revenues to get a clearer picture on RIGL’s push towards breakeven and profitability with Q1’23 earnings.

7 Wall Street analysts have issued 12 month target prices for Rigel Pharmaceuticals’ stock. Their RIGL share price forecasts range from $1.00 to $15.00. On average, they anticipate the company’s share price to reach $4.21 in the next year. This suggests a possible upside of 275.7% from the stock’s current price. View analysts price targets for RIGL or view top-rated stocks among Wall Street analysts.

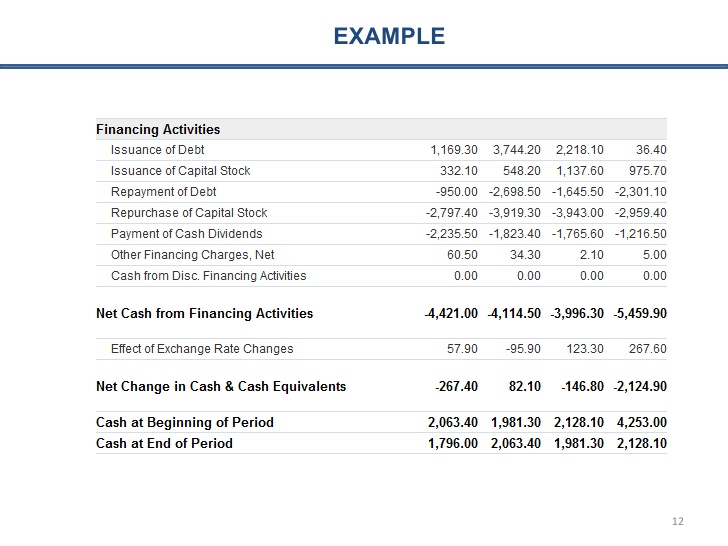

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. CompareRIGL’s historical performanceagainst its industry peers and the overall market. Our Quantitative Research team models direct competitors or comparable companies from a bottom-up perspective to find companies describing their business in a similar fashion. Fourth quarter 2022 Total Revenue of $51.3 million which includes TAVALISSE® net product sales of $21.9 million and REZLIDHIA™ net product sales of $0.9 million REZLIDHIA U.S. commercial launch contin…

The Company is engaged in discovering, developing and providing therapies that improve the lives of patients with hematologic disorders and cancer. The Company’s lead product, TAVALISSE tablets, the spleen tyrosine kinase inhibitor, for the treatment of adult patients with chronic immune thrombocytopenia . High-growth stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

Rigel Announces Conference Call and Webcast to Report Fourth Quarter and Full Year 2022 Financial Results and Business Update

March 7, with Tavalisse net sales of $21.9M for the quarter, up from the quarter prior ($19.2M) and Q4’21 ($17.6M). The sales growth is supported by an increase in the number of bottles shipped to clinics, for example 2,196 bottles were shipped in Q4’22, representing a 23% increase vs Q4’21. Growth that isn’t the result of price increases is a big positive for Tavalisse in the ITP indication. Rigel Pharmaceuticals Inc develops small-molecule drugs for autoimmune, cancer-related, and viral diseases.

- Early clinical data support olutasidenib’s potential as a treatment for AML and MDS, in both the relapsed/refractory and newly diagnosed settings Olutasidenib showed durable remission in treatment-naï…

- View the RIGL premarket stock price ahead of the market session or assess the after hours quote.

- It can also be calculated by dividing the company’s Market Cap by the Net Profit.

- 52 week high is the highest price of a stock in the past 52 weeks, or one year.

Real-time analyst ratings, insider transactions, earnings data, and more. Rigel Pharmaceuticals’ stock was trading at $1.50 at the beginning of the year. Since then, RIGL shares have decreased by 25.3% and is now trading at $1.12.

Rigel Pharmaceuticals Inc (RIGL)

While there are some questions worth addressing on RIGL’s cash balance, the company is pushing towards breakeven and potentially profitability. RIGL is set to report Q1’23 earnings on Tuesday, May 2, with the stock currently trading around year-to-date lows. Investing.com – U.S. equities were higher at the close on Tuesday, as gains in the Oil & Gas, Basic Materials and Industrials sectors propelled shares higher. Investing.com – U.S. equities were higher at the close on Wednesday, as gains in the Industrials, Oil & Gas and Basic Materials sectors propelled shares higher. Investing.com – U.S. equities were lower at the close on Wednesday, as losses in the Basic Materials, Utilities and Industrials sectors propelled shares lower.

- Style is calculated by combining value and growth scores, which are first individually calculated.

- Style is an investment factor that has a meaningful impact on investment risk and returns.

- The Company is engaged in discovering, developing and providing therapies that improve the lives of patients with hematologic disorders and cancer.

- Only 13 people have searched for RIGL on MarketBeat in the last 30 days.

These are established companies that reliably pay dividends. / Sales ,37x Nbr of Employees 155 Free-Float 98,3% More FinancialsCompanyRigel Pharmaceuticals, Inc. is a biotechnology company. The risks of any long in RIGL are several fold, a few of which I’ll mention here. Firstly, Rezlidhia sales could underwhelm even if there is growth quarter-over-quarter. Secondly, disappointing results in any of RIGL’s clinical trials could see the stock trade down.

Since 1988 it has more than doubled the S&P 500 with an https://1investing.in/ gain of +24.48% per year. These returns cover a period from January 1, 1988 through March 6, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

The firm’s lead drug is an oral rheumatoid arthritis drug candidate that has been licensed to AstraZeneca. Astra has taken overall responsibility to develop and market the drug and will pay Rigel royalties and milestone payments. Its pipeline product includes TAVALISSE tablets, the only oral spleen tyrosine kinase inhibitor, Fostamatinib, R289, R552, R835, DS-3032, THF-beta Inhibitors, and AZD0449- Inhaled JAK Inhibitor. REZLIDHIA™ U.S. FDA approval and commercial launch for the treatment of adult patients with relapsed or refractory AML with susceptible IDH1 mutation Preliminary fourth quarter 2022 Total Revenue of a…

At the very least we’ll have more clarity on revenue growth with Tavalisse (such as confirming the strong Q1’23 to which the CEO alluded), and the launch of Rezlidhia. Outside of sales of Tavalisse and Rezlidhia, or upfront payments from partnering Rezlidhia or R289, RIGL also has the potential to bring in milestone payments from its existing collaborators. RIGL is also considering partnering R289, the company’s IRAK1/4 inhibitor, which is currently in a trial in patients with myelodysplastic syndromes . Still the CCO did say the company was making progress in that regard and so with Q1’23 earnings we might expect some confirmation that the company has continued to make strides to reach the target prescribers.

52 week low is the lowest price of a stock in the past 52 weeks, or one year. Rigel Pharmaceuticals 52 week low is $0.64 as of April 28, 2023. 52 week high is the highest price of a stock in the past 52 weeks, or one year. Rigel Pharmaceuticals 52 week high is $2.71 as of April 28, 2023. There may be delays, omissions, or inaccuracies in the Information.

4 Top Penny Stocks To Watch With Big Biotech News This Quarter – Penny Stocks

4 Top Penny Stocks To Watch With Big Biotech News This Quarter.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

Rigel Pharmaceuticals Inc share price live 1.140, this page displays NASDAQ RIGL stock exchange data. View the RIGL premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Rigel Pharmaceuticals Inc real time stock price chart below.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Just because this past year has been difficult, doesn’t mean that we can’t approach the New Year with a degree of hope. Inflation has shown some signs of moderation, and if that holds, we can look forward to some consequen… The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries.

The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. So at the end of last year you had about $58 million in cash and cash you burn for this year since running higher than that. So can you talk about how you fund the operations for this year and beyond…

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and … – InvestorPlace

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and ….

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

Rigel Pharmaceuticals’ stock is owned by a variety of retail and institutional investors. Top institutional investors include Assenagon Asset Management S.A. (0.75%), Connecticut Wealth Management LLC (0.07%) and Allspring Global Investments Holdings LLC (0.05%). Insiders that own company stock include David A Santos, Dean L Schorno and Raul R Rodriguez. 6 employees have rated Rigel Pharmaceuticals Chief Executive Officer Raul Rodriguez on Glassdoor.com.

There’s a lot to be optimistic about in the Healthcare sector as 2 analysts just weighed in on BioCryst (BCRX – Research Report) and Rigel (RIGL – Research Report) with bullish sentiments. Rigel Pharmaceuticals Inc. stock roared more than 16% higher Thursday, but the potential catalyst for that move was a mistake, the company said after markets closed Thursday. Shares of Rigel Pharmaceuticals Inc. shot up 9% in premarket trade Wednesday after the company announced it had entered a license and supply agreement with Spain-based Grifols, S.A. Rigel Pharmaceuticals Inc. shares soared 39% in premarket trade Thursday, after the company said it has agreed to partner with Eli Lilly and Co. in developing RIPK1 Inhibitors to treat immunological and neurodegenerative… Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

So we’re comfortable with our current cash position in the business that we’ve discussed today. We — with respect to the path to profitability, we really do as a company, it is a priority for our business to achieve cash flow breakeven… We are reducing our operating expense from about $176 million in 2022, the numbers we just reported, down to what we expect to be about $160 million this year. I would note that over $10 million of the operating expenses I just described are non-cash, they are stock comp and depreciation.